national health investors inc. (reit) dividend

Nareit serves as the worldwide representative voice for REITs and real estate companies with an interest in US. Omega is a real estate investment trust that invests in the long-term healthcare industry primarily in skilled nursing and assisted living facilities.

National Health Investors Inc Nhi Dividends

And operates railroad systems in North America.

. These are issued or guaranteed by US-government-sponsored enterprises such as Fannie Mae Freddie Mac or Ginnie Mae. The best dividend ETFs in Canada use investor funds to buy and hold a basket of high-paying dividend stocks. This would be the case as many consider dividend stocks as a safe haven in times of volatility.

It pays a dividend yield of 1319 putting its dividend yield in the top 25 of dividend-paying stocks. Instead of picking individual dividend stocks on your own and worrying about diversification dividend ETFs are pre-designed to be diversified across various sectors and industries. ARMOUR Residential REIT has only been increasing its dividend for 1 years.

Nareits members are REITs and other real estate companies throughout the world that own operate and finance income-producing real estate as well as those firms and individuals who advise study and service those businesses. Omega Healthcare Investors Inc. National CineMedia Inc.

ARMOUR Residential REIT Inc is a real estate investment trust that invests in residential mortgage-backed securities or RMBS. It can be considered a good option for investors seeking cheap high dividend stocks to buy right now. Berkshire Hathaway Inc through its subsidiaries engages in the insurance freight rail transportation and utility businesses worldwide.

The 1 Source For Dividend Investing. NYSEOHI Delivered A Weaker ROE Than Its Industry Simply Wall St. ARMOUR Residential REIT is a leading dividend payer.

With inflation rising and the threats from the Omicron variant stocks with high dividend yields could help stabilize ones portfolio. It provides property casualty life accident and health insurance and reinsurance. Besides investors can expect regular cash flows and there is a possibility of decent capital gains over time.

In this article I cover some of the best Canadian dividend. ARMOUR Residential REIT Dividend Yield 112. BACs dividend yield history payout ratio proprietary DARS rating much more.

The dividend payout ratio of ARMOUR Residential REIT is 7273.

National Health Investors Inc Nhi Nyse Reit Notes

Nhi Nhi Provides Business Update

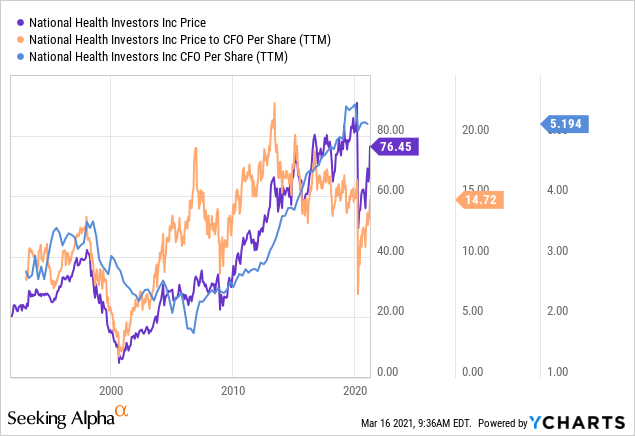

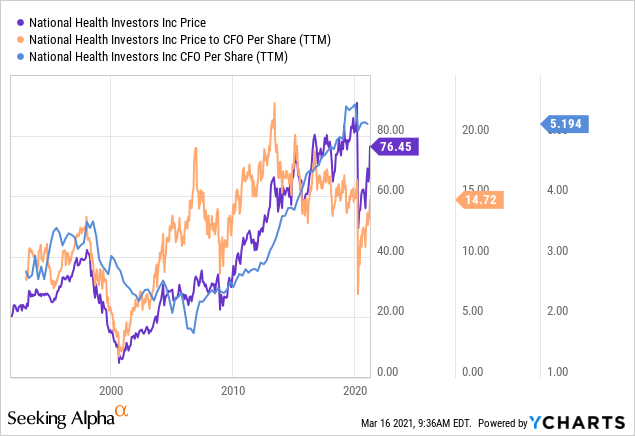

National Health Investors Buy Nhi Stock When It S Cheap Seeking Alpha

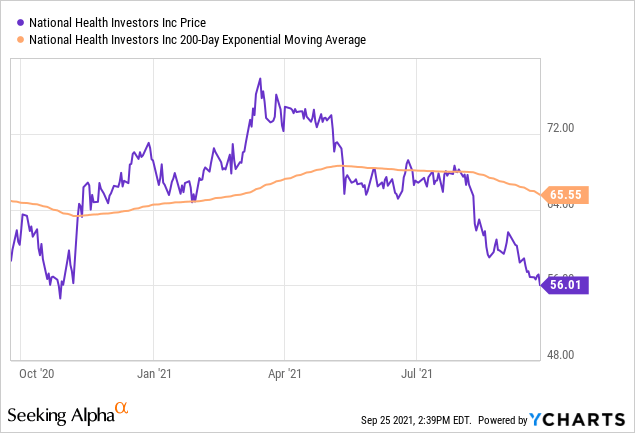

National Health Investors 2021 May See Dividend Cut Due To Rent Deferrals Nhi Seeking Alpha

National Health Investors Home Facebook

National Health Investors Reit Strong Fundamentals Low Price Nyse Nhi Seeking Alpha

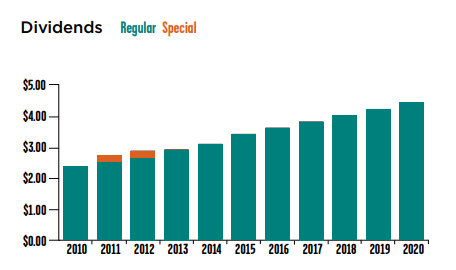

Nhi National Health Investors Inc Dividend History Dividend Channel